Neoprene rubber, also known as polychloroprene, is a synthetic rubber widely used for its durability, flexibility, and resistance to environmental elements like heat, oil, and chemicals. It plays a vital role in industries such as automotive, construction, textiles, and electronics. Understanding the price trends of neoprene rubber is crucial for manufacturers, suppliers, and end-users in these sectors. In this blog, we will explore the recent price trends, factors affecting the pricing, market dynamics, and future outlook for neoprene rubber.

Forecast Report

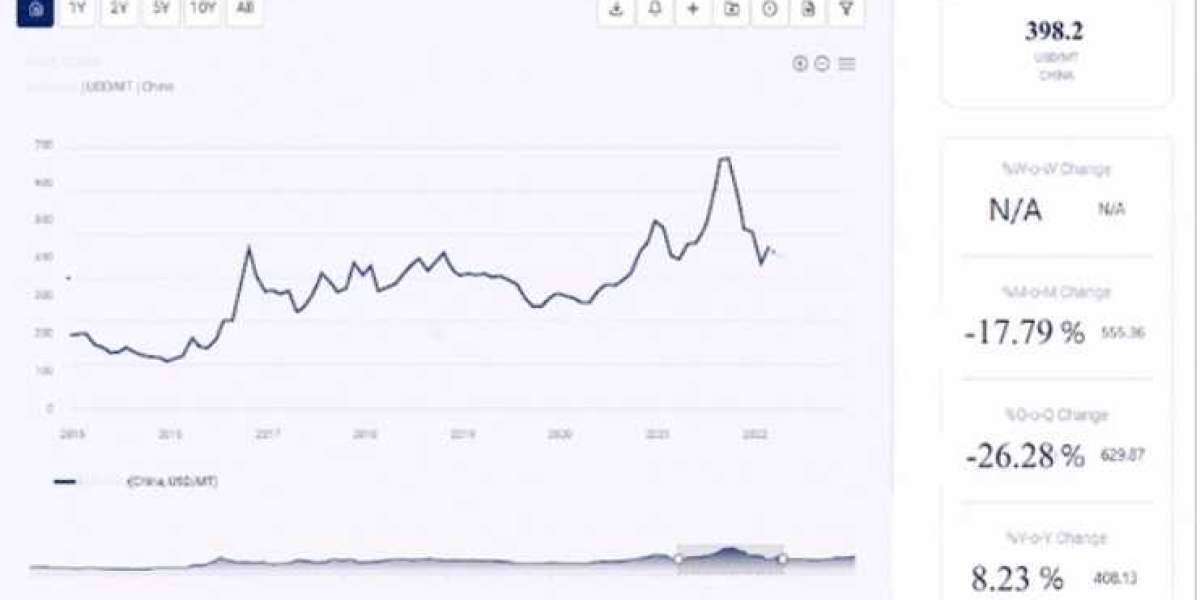

Neoprene rubber prices have experienced fluctuations in recent years, influenced by various market conditions. The global demand for neoprene has been stable due to its usage in diverse applications, particularly in automotive parts, gaskets, and seals. However, the prices have been sensitive to changes in the supply chain, especially considering raw material shortages and environmental regulations affecting production.

The price of neoprene rubber in 2023 ranged from $2,800 to $3,200 per metric ton, depending on the region and quality. The key drivers of price movements include raw material costs (chloroprene monomer), energy prices, and production capacity. Asian markets, particularly China, play a major role in neoprene production, and any disruption in supply from this region has a direct impact on global prices.

Request For Sample: https://www.procurementresource.com/resource-center/neoprene-rubber-price-trends/pricerequest

Outlook

The outlook for neoprene rubber prices in the near term is mixed. While demand is expected to remain steady, several factors could lead to volatility. For instance, ongoing environmental regulations aimed at reducing carbon emissions may result in stricter controls on the production of raw materials, pushing production costs higher. Additionally, fluctuations in crude oil prices, which affect the cost of petrochemical derivatives used in neoprene manufacturing, may lead to further price changes.

Technological advancements and innovations in neoprene rubber production processes may help to stabilize prices by improving efficiency and reducing waste. However, geopolitical tensions, trade policies, and transportation costs remain key factors that could influence price trends.

Market Dynamics

The neoprene rubber market is characterized by several dynamic forces that influence its pricing and demand:

Supply Chain Disruptions: The global supply chain for neoprene rubber is often impacted by geopolitical tensions, trade tariffs, and logistical challenges. For example, delays in shipments from China or Southeast Asia can lead to price spikes in European and North American markets.

Environmental Regulations: Neoprene rubber production is heavily regulated due to environmental concerns regarding the production of chloroprene monomer, a key raw material. Stricter emissions standards and sustainability initiatives can increase production costs, which are eventually passed on to consumers.

Demand from End-Use Industries: The demand for neoprene rubber is highly influenced by industries such as automotive, construction, and electronics. Economic growth in emerging markets and the rising trend of electric vehicles are expected to increase demand for neoprene products, potentially driving up prices.

Technological Innovations: Advances in synthetic rubber technologies, such as bio-based neoprene alternatives, may affect the overall market by reducing reliance on petroleum-based raw materials. This could lead to a gradual price stabilization as alternative production methods become more cost-effective.

Demand-Supply Analysis

The neoprene rubber market has experienced supply constraints in recent years due to raw material shortages, particularly in Asia. As one of the leading producers, China’s production levels directly affect the global supply chain. Any disruptions in production or exports from China can create a ripple effect, leading to tighter supplies and higher prices in other regions.

On the demand side, the growth of the automotive and construction industries has led to an increase in the consumption of neoprene rubber. Its use in sealing, gaskets, hoses, and belts remains a key factor driving demand. However, some industries are seeking alternatives to neoprene rubber due to environmental concerns and the rising costs associated with production. This may lead to a slight softening of demand in the long term, but for now, the market remains strong.

Extensive Forecast

Based on current market conditions, the price of neoprene rubber is expected to remain relatively stable, with minor fluctuations due to external factors such as energy costs and geopolitical tensions. Analysts forecast that prices could range from $2,700 to $3,300 per metric ton over the next 12 months, depending on regional market conditions.

In Asia-Pacific, which is the largest producer and consumer of neoprene, prices are expected to be on the lower end of the spectrum due to the availability of raw materials and proximity to manufacturing hubs. However, in regions like North America and Europe, prices may be higher due to transportation costs and lower production capacities.

Detailed Insights

Raw Material Costs: Chloroprene, the primary raw material for neoprene rubber, is derived from butadiene, which is influenced by crude oil prices. Any significant rise in oil prices tends to increase the cost of neoprene rubber production.

Regional Trends: Asia-Pacific remains the dominant producer of neoprene rubber, with China and Japan accounting for a large share of global production. North America and Europe rely heavily on imports, making them vulnerable to price fluctuations based on global supply and demand trends.

Technological Developments: New methods of neoprene production, including bio-based alternatives, are being explored. These innovations have the potential to lower production costs and create more environmentally friendly alternatives, but widespread adoption is still in the early stages.

Environmental Impact: Neoprene rubber production has come under scrutiny for its environmental impact, leading to tighter regulations. This has pushed producers to explore more sustainable production processes, which could affect future pricing.

Conclusion

Neoprene rubber prices are subject to a complex set of factors, including raw material availability, environmental regulations, and global demand from end-use industries. While prices have been relatively stable, the outlook for 2024 and beyond includes potential volatility driven by environmental concerns, raw material costs, and technological advancements. Staying informed about these trends will be key for manufacturers and suppliers navigating the neoprene rubber market.

Contact Us:

Company Name: Procurement Resource

Contact Person: Endru Smith

Email: [email protected]

Toll-Free Number: USA Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537 132103 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: https://www.procurementresource.com/